Over the next seven years, the Federal Government is poised to squander triple the amount of money spent fighting WWII. And that’s adjusted for inflation! Total unfunded liabilities on the federal ledger consistently exceed the GDP of the entire world. The government could raise the top marginal income tax rate to 100% for all those shysters making more than $250K annually and not even cover the deficit. They could liquidate the assets of every Fortune 500 company and every billionaire in America, yet red ink would still flow from Imperial fountain-pens like human and animal waste down the Ganges. “Fear Not!” say the demagogues. “It’s not a spending problem, but a revenue problem!”

Once upon a time, such deluded statements earned one a trip to the doctor. Now, they get you an esteemed economics faculty position at some prestigious university. I got to know this phenomenon well when I studied Principles of Macroeconomics under Anne Gongwe, a professor at Colorado State University. Anne is a delightful person, but I must say, her Ph.D. would better serve as kindling for Rick’s readers during the coming collapse than as a qualification to inculcate young minds. According to her, a lull in the rate of inflation constitutes deflation; Chinese speculators caused the housing bubble; and, the response to timid capital is a shot of liquidity (i.e., inflation).

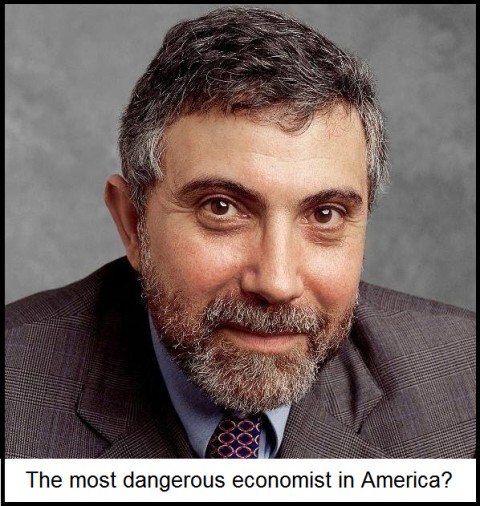

Of course Ms. Gongwe is not at fault. Rather, this battiness pervades the highest ranks of collegiate economics. After all, our required text, Macroeconomics, was co-authored by everybody’s favorite left-wing loony, Nobel Prize-winning economist Paul Krugman (the very same Nobel Prize held by warlord-in-chief Barack Obama and Yasser Arafat). Apparently Krugman’s calls to lower interest rates in the early 2000s to stimulate housing speculation were not enough to dissuade academia of his brilliance.

On page 14 of his book, in the introductory How Economies Work section, we learn that “Markets usually lead to efficiency,” but when they don’t, “Government intervention can improve society’s welfare.” Krugman cites the example that motorists have no incentive not to congest traffic on public roads. He posits that the government can solve the problem by “subsidizing the cost of public transportation and taxing the sale of gasoline to individual drivers.” Problem solved. Krugman frames the issue as a “market failure” despite public roads being as divorced from the market price system as a Soviet bread line.

Orwellian Disinformation

But the Orwellian mis- and dis-information doesn’t stop there. Last week, a friend of mine, Eric Roche, a former Young Americans for Liberty activist at Colorado State University, related a story to me of how his econ professor was unaware that the Federal Reserve system existed prior to the Great Depression, and how she “informed” the class that interest rates were set by the free market during the 1920s.This was the sort of thing that motivated me to read more on my own. When the instructors are not outright misinformed, they spew the statist/Keynesian narrative that has put our country in such dire straits. I had to correct my teachers on a nearly daily basis, and that’s not how education is supposed to work. In tandem with an awareness of the looming Education Bubble, the aforementioned dynamic of systemic indoctrination drove me to abandon my pursuit of a bachelor’s degree. I anticipate a growing trend of young students doing the same thing. Leaving “Higher Education” has offered a great opportunity to learn and attain some marketable skills. I only regret there being one less person in the halls of academia to challenge the status quo.

***

No comments:

Post a Comment